-

Our Community

-

- Welcome Visitors About Durham's Community Climate Remembrance Project Diversity Welcome Statement Life in Durham Places to Stay Places to Eat Places to Park Transportation Schools Oyster River School District Welcome New Homeowners

- Durham Public Library Programs & Events Trails and Town Lands Conservation Commission Land Stewardship Conservation Lands & Parks Conservation Easements Trails Youth Organizations University of New Hampshire Durham Preservation Durham Historic Association

- Volunteer Town of Durham Land Stewardship Public Library UNH Cooperative Extension Churchill Rink Parks & Recreation Recreation Program Calendar Outdoor Recreation Activities Outdoor Recreation Sites Sustainable Durham Recycling Information Swap Shop Information Earth Day 2023

-

- Doing Business

-

Inside Town Hall

-

- Departments Assessing Building Business Office Code Enforcement Information Technology Planning Town Clerk/Tax Collector Parks & Recreation Boards, Commissions & Committees Agricultural Commission Conservation Commission Historic District/Heritage Comm. Other Boards & Committees Planning Board Zoning Board

- DCAT Media Productions DCAT Media - Programming DCAT Media Livestream Zoom Video Meeting Schedule Town Council Town Administration Public Hearings Public Safety Police Fire McGregor Memorial EMS (Ambulance)

- Public Works Engineering Division Operations Division Sanitation Division Water Division Wastewater Division Stormwater Town Directory Telephone Directory by Department Services Directory

-

-

Helpful Resources

-

- Quick Links Assessors Online Database Bids and RFP’s DCAT Media Productions GIS Digital Maps Jobs Online Services Parking Information Social Services Town Holidays Trash Pick Up Holiday Schedule Transfer Station & Recycling Center Information Curbside Refuse Collection by Street Zoom Video Meeting Schedule

- Town Documents Budget & CIP Forms & Applications Master Plan Tax Increment Finance (TIF) Districts Tax Maps Town Charter Town Code Town Reports Town Wide Master Fee Schedule Zoning Ordinance Voter Information

- Contact Us Cemetery Information Social Media Facebook Twitter Town Newsletter Friday Updates Town Meetings & Events Agenda and Minutes Calendar Public Hearing Notices State & U.S. Representatives

-

Property Tax & Utility Collection Information

Property Tax Quick Reference

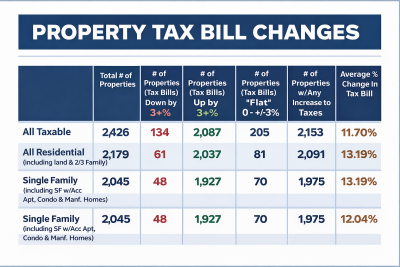

Your property tax bill is based on your property’s assessed value and the combined town, school, and county tax rates. New Hampshire relies heavily on property taxes to fund local services, as the state does not have a broad income or sales tax. Your bill is calculated by multiplying your assessed value by the tax rate (per $1,000 of value).

Bills can increase if property assessments rise or if local budgets for schools, roads, or public safety require more funding. Rising assessments indicate that your property is appreciating in value, which is a good thing. Current factors driving increases in local government and school budgets include rising healthcare costs, inflation, and reductions in federal and state funding.

Billed Twice Per Year:

- July: Estimated half of last year’s bill (prior year tax rate and assessment)

- December: Final bill with current tax rate, minus July payment

Next Due Date: January 12, 2026

- 2025 Tax Rate: $18.87 per $1,000 assessed value

- Example: $500,000 ÷ 1,000 × $18.87 = $9,435 total annual tax bill (Jul+Dec)

Payment Options:

- Cash, Check, Credit/Debit Card (fees may apply)

- Online, in-person, 24 hr dropbox, or by mail

Mailing Address

Town of Durham – Tax Collector

8 Newmarket Road, Durham, NH 03824

Deadlines & Partial Payments:

- Due within 30 days of bill date

- Partial payments accepted; interest accrues until fully paid

- Escrow Accounts: Property owners receive the bill even if mortgage company pays

Utility Quick Reference

- Billing: Quarterly (FEB, APR, JUL, OCT)

- Responsibility: Property owner

- Non-Payment: Unpaid bills added as property tax lien each August